Image from: www.linkedin.com

As we venture into 2025, the financial landscape is poised for a groundbreaking transformation, fueled by a wave of fintech innovations. These advancements are reshaping how individuals and businesses interact with their finances, offering enhanced security, accessibility, and personalized experiences. Let’s dive into the top trends that are set to disrupt the financial industry.

1. AI-Powered Financial Advisors

Imagine having a personal financial advisor that’s always available. Enter AI-powered financial advisors. These smart systems are designed to analyze your financial habits and goals, offering tailored investment advice. With their machine learning capabilities, they evolve over time, ensuring you receive the most relevant insights to help you make informed financial decisions.

2. Blockchain for Unmatched Security

The buzz around blockchain technology is more than just hype; it’s a game changer. This decentralized ledger ensures that transactions are secure and transparent. As we move into 2025, expect more financial institutions to harness blockchain for a variety of applications, from speedy cross-border payments to foolproof smart contracts, all while minimizing fraud risks.

3. Revolutionizing Digital Wallets

Cash is quickly becoming a relic of the past, thanks to the rise of digital wallets. These apps not only store your payment information but are also evolving with features like biometric authentication and real-time tracking. By 2025, digital wallets will seamlessly integrate with loyalty programs and support instant peer-to-peer payments, making everyday transactions a breeze.

4. Robotic Process Automation (RPA)

Say goodbye to tedious manual tasks! Robotic Process Automation (RPA) is here to transform back-office operations within financial institutions. By automating repetitive activities, RPA reduces human error and cuts costs, freeing up employees to focus on strategic initiatives that enhance customer experiences.

5. The Surge of Decentralized Finance (DeFi)

The rise of Decentralized Finance (DeFi) is shaking up traditional banking models. By allowing users to engage directly with financial services—without intermediaries—DeFi platforms are making lending, borrowing, and trading more accessible and cost-effective. As this sector continues to evolve, it promises to democratize finance for everyone.

6. Personalized Banking Experiences

With the power of data analytics, personalized banking is becoming a reality. Financial institutions will increasingly leverage customer insights to craft tailored services that meet individual needs. By 2025, expect banks to offer highly customized financial solutions that resonate with their customers, boosting satisfaction and loyalty.

7. Open Banking and API Integration

The trend of open banking is ushering in a new era of financial services. By granting third-party developers access to financial data through API integration, banks can offer innovative and collaborative solutions that enhance user experiences. This approach will foster partnerships between fintech companies and traditional banks, driving further innovation.

8. Cybersecurity Innovations

As digital transactions surge, cybersecurity has never been more critical. In 2025, fintech companies are likely to invest heavily in advanced security measures, including AI-driven threat detection and biometric authentication. These innovations will be essential for protecting sensitive financial data and maintaining customer trust.

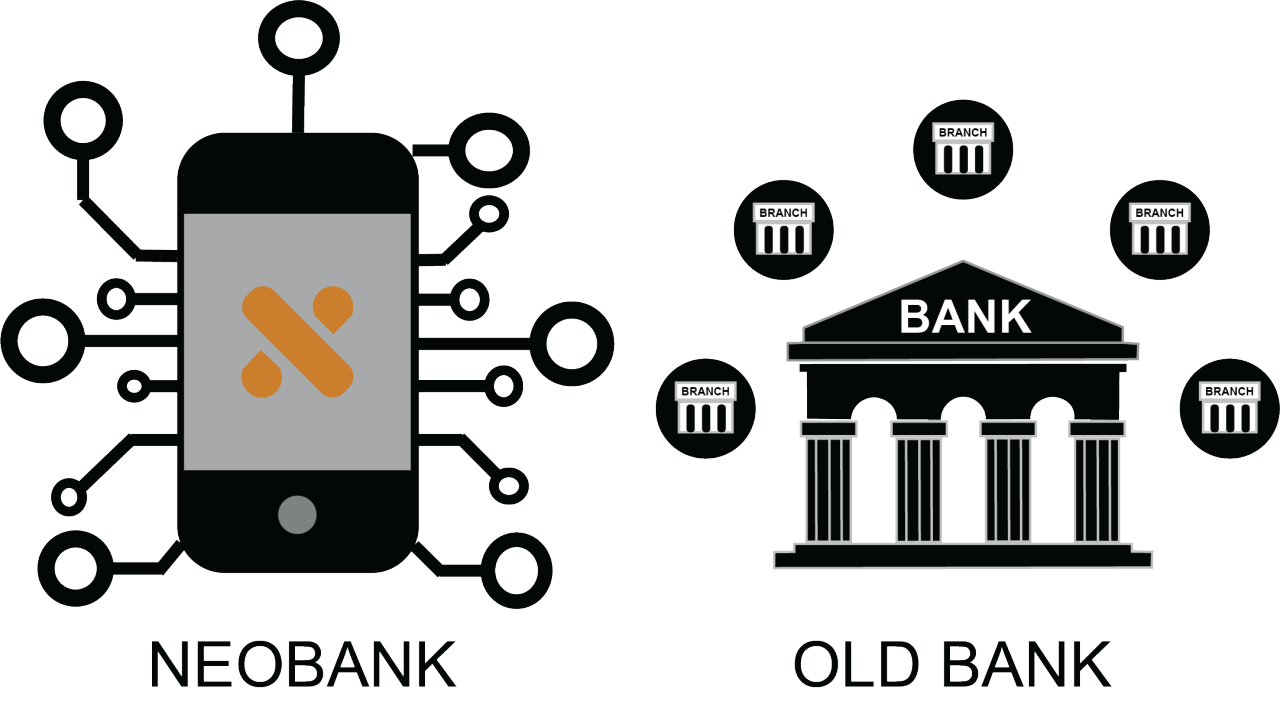

9. The Rise of Neobanks

Neobanks are redefining the banking experience by operating entirely online. These digital-first banks attract consumers with lower fees and user-friendly platforms, catering especially to tech-savvy younger generations. By 2025, neobanks will continue to disrupt traditional banking models, offering greater transparency and convenience.

10. Embracing Cryptocurrencies

The acceptance of cryptocurrencies is on the rise, and financial institutions are taking notice. By 2025, we can expect more banks to offer services related to digital assets, including cryptocurrency wallets and trading platforms. This shift will not only make digital currencies more accessible but will also encourage mainstream adoption.

In summary, the financial industry in 2025 will be defined by these exciting fintech innovations that promise to enhance security, accessibility, and personalization. By embracing these trends, both businesses and consumers will be better equipped to navigate the ever-evolving financial landscape, leading to a more inclusive and efficient financial ecosystem.